Pipe: A liquidity foundation for the Harmony ecosystem

Overview

Pipe is a liquidity machine with one primary mission: drastically increase the total volume locked (TVL) on Harmony. Pipe accomplishes this by building several decentralized apps (dApps) all under a single umbrella. These dApps have been specially crafted to work together, increasing demand for the underlying PIPE token while also creating a flywheel effect — the sum is much greater than any of its individual components. The components of Pipe, as well as the relative order of priority is broken down below.

Priority 0 - Initial Launch

The foundation is built on a DEX, built specifically to keep slippage low for stable or pegged swaps such as DAI / USDC and stONE / ONE. Swap fees are a primary foundation of our sustainability (see section below).

Pipe will also implement locking (freezing) mechanics for the underlying token. By transforming PIPE to fzPIPE, the user can boost their own APR, a specific pool’s APR, and vote on governance proposals. Freezing for the maximum of 4 years will result in more voting power, while freezing for shorter time periods will have reduced voting power relative to the underlying frozen PIPE. fzPIPE will be non-transferrable, reducing circulating supply.

fzPIPE can participate in gauge voting to earn rewards from a share of the DEX fees in the form of PIPE. fzPIPE holders can allocate their votes across the pools and LPs offered on PIPE to increase the APR on those pools for a set period of time. If they are undecided, they can perpetually allocate their votes to the Launchpad pool to support the bootstrap liquidity of new projects launching on Harmony.

Users will be able to mine Pipe by providing liquidity for DEX pairs and voting to direct liquidity using fzPIPE. Earning PIPE in this manner is called Proof of Liquidity Engagement or PoLE for short.

Priority 1 - Harmony Launchpad

Pipe will introduce “Delegation Pools”. Votes in these pools are controlled by another party. The first delegation pool will be a “Harmony Launchpad”. Tokens allocated to the launchpad will be redirected to projects’ liquidity that Pipe and the Harmony community cooperatively determine to be valuable for Harmony’s stability and long term growth.

Harmony, like other chains, is always looking for ways to grow their chain and incentivize users. We anticipate there will be a portion of Pipe users that either 1) don’t have strong preferences for where their fzPIPE is allocated or 2) want to support the Harmony ecosystem.

This also reduces complexity for an average user, while letting them feel good about helping an ecosystem they’re invested in.

Priority 2 - Leveler

P0 and P1 build the foundation. P2 is where we expect mass adoption to occur. Up until now, interacting with Pipe requires some understanding of Defi, pools, LP, etc. With Leveler, that complexity is abstracted away.

Leveler will be a portfolio management software. At its most basic, a user will specify the amount of risk they are willing to take and deposit their principal. From that point forward, the user only needs to interact with Leveler when they wish to claim their earnings or withdraw their principal.

Behind the scenes, Leveler is interacting with the DEX. Providing LP, moving LP from one pool to another, auto compounding rewards, etc.

This simplified interface (both from a website design level, but also the smart contract level) is key to our next steps: integrating with Harmony Multisig wallets and Harmony 1Wallet. There’s an abundance of underutilized capital on the Harmony chain, and this is Pipe’s path to put it to work. Integrating with 1Wallet will help meet Harmony’s 20% basic income goal, as well as promote new user growth with simple and easy ROIs.

Priority 3 - Bribe Delegation Pool

Similar to the Harmony Launchpad, but with a profit maximizing rather than altruistic purpose. A marketplace will be developed linking bidders with fzPIPE holders.

Weekly rounds will be held where anyone can “bribe” the pool. To submit a bribe, the maximum number of fzPIPE votes in addition to the dollar value per fzPIPE will be specified. When the round is over, the bids are filled (highest to lowest bid prices) until no more fzPIPE votes remain. The bribes are then distributed to those that allocated their fzPIPE to the bribe pool, less a 5% fee distributed to the Pipe treasury.

Priority 4 - PIPE Cash

PipeCash is inspired from Liquity on Ethereum. PipeCash will allow ONE holders to borrow a native stablecoin (pUSD) against their collateral for added flexibility and/or ability to participate in stablecoin liquidity mining on the Pipe stable-asset DEX. PipeCash can work with Leveler to maintain an automated loan to value ratio.

For example, PipeCash would give DAOs or the Harmony Foundation access to stablecoin liquidity for operations or an additional way to earn yield without selling their ONE.

PipeCash will offer 0.1% interest loans (compared to the 0% Liquity currently offers) to contribute to PIPE protocol sustainability and positive pressure on the PIPE token.

Accounting for Harmony’s higher volatility relative to other chains, PipeCash will use a 150% over-collateralized trove system to allow pUSD to be borrowed and redeemed at a pegged $1 price.

PipeCash will also seek support with multiple CEXes to allow for native deposit and withdrawal, as stablecoin on/off ramps are desperately needed on the Harmony chain.

See Liquity Docs for specific mechanics.

Design

Prototype

Interactive Prototype for PIPE

Launch Plan & Milestones

Milestones

- 10,000 bootstrap cost

- 50,000 for DEX stableswap deployed to testnet - Expected delivery Aug 1

- 50,000 for gauges and delegation deployed to testnet - Expected delivery Aug 21

- 50,000 for DEX non-pegged swap deployed on testnet - Expected delivery Sept 4

- 90,000 for release of the above on mainnet - Expected delivery Sept 14

See our Pipe Execution Timeline for more details and plans beyond P0.

Sustainability

Sustainability as a concept has been talked about a lot in recent months, and it should be. While launching a protocol takes capital (ahem… smart contract audits anyone ![]() ) we have a clear path towards long term sustainability.

) we have a clear path towards long term sustainability.

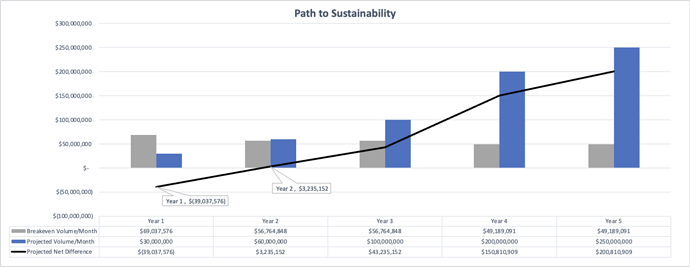

Pipe’s path to sustainability involves decreasing overhead (breakeven point) through reduction of large one-time expenses such as the “product launch” marketing expenses and large security audits on new code while simultaneously increasing volume on the Pipe DEX through introduction of new tools and token pools. With our conservative volume growth estimates, the protocol would be self sufficient and profitable by the end of Year 2.

This revenue only accounts for trading revenue and does not include other revenue streams.

For information about our planned use of the initial funds to please see Pipe Runway.xlsx.

Revenue

Pipe collects revenue from several sources. In P0, the following revenue sources are available:

- DEX swap fees

- Revenue share from fzPIPE

By P4, several additional revenue sources are added.

- Bribe revenue share

- Performance fees from Leveler

- Interest from PipeCash loans

- NFT accessories for fzPIPE critters

Five Year Projected Revenue

Link to Source: Pipe Proj Income Statement.xlsx

Ask

We request $250,000 in ONE token. We anticipate this to cover an audit and a portion of our development expenses. All other members of our team have agreed to work solely for PIPE tokens, and devs are being compensated at below market rate until sustainability is reached.

| Title | Est. Cost | Hourly | Commitment | Notes |

|—|—|—|—|—|—|----------------------------------|------------:|--------|------------|---------------------------------------|

| Lead Dev | 96,000 | 37.5 | 40+ hours | Tokens as additional compensation |

| Back-end Dev | 48,000 | 75 | 20 hours | |

| Front-end Dev | 48,000 | 75 | 20 hours | |

| Graphics/UI Designer | | | 40+ hours | Will work for tokens during bootstrap |

| Biz Dev | | | 40+ hours | Will work for tokens during bootstrap |

| Team Lead | | | 40+ hours | Will work for tokens during bootstrap |

| Community/Marketing | | | 40+ hours | Will work for tokens during bootstrap |

| Code Audit | 200,000 | | | Security |

| Incorporation in Switzerland | 12,000 | | | Compliance |

| General Operating OH Expenses | 2,314 | | | Operations |

| Total | 406,314 | | | |

Projected Funding Runway

Link to Source: Pipe Runway.xlsx

In addition to funding, Pipe proposes a co-marketing campaign for the upcoming launch of the trustless Ethereum bridge and existing Bitcoin bridge. Pipe’s stable pools serve as an excellent yield bearing opportunity for wBTC/1BTC liquidity, as well as ERC-20 stablecoins looking for a new home on a faster and more affordable chain.

As a show of good faith, Pipe will give Harmony a portion of the total supply of PIPE token to participate in early governance. See tokenomics for more information.

Links & Resources

- Team and Commitments

- Pitch Deck

- Extended Roadmap

- Timelines

- Tokenomics

- Token Flow

- 1-ish Pager

- 6 Pager

- Market and Peer Analysis

- Pipe ELI5

- Proof-of-concept prototype

Edit: 6/16 Fixed terminology on path to sustainability graphic