Very interesting to see this discussion here.

I wanted to create a new thread in Talk Harmony but I can’t seem to find anywhere that we can start general discussions (maybe a community discussion tab?). Anyway, I’ll make some comments here for now, although I might be going a bit off on a tangent.

I think you should read this article https://bit.ly/3ChpyAi .

This sentence from the article “behind-the-scenes conflicts breed a lot of drama” echoes here and I had a quick sort of unnecessary “drama” experience as well.

Read this article carefully, it might sound all doom and gloom but it is not and has some strong points.

We need to stop using crypto to just make fiat profits. Personally, as long as I can pay the basic bills

I want to keep all the coins in the ecosystem. Difficult I know as I am struggling to get new project work to pay my bills but I try as much as I can to not to cash to fiat.

I keep seeing project after the project they keep bleeding token value.

I have $30K in $VIPER locked rewards which I was planning to reinvest and eventually to pay my house off by the end of 2022 and now worth less than £3K. This is very depressing and demotivating. The worst thing is all is locked and I can’t use them at least on other projects.

The Defi space in @harmony is amazing but as the article says “The technology will evolve while the price bleeds for months”

Let’s not make that happen. We are building the tech let’s build it so this “prophesy” will not become self-fulfilling.

We need to prove the value of $ONE and HRC20 tokens being more just the price

We need a utility for all the tokens.

I started Harmony Pay.

The idea basic idea of Harmony Pay (there is much more) is that “Jo public” would want to keep $ONE and HRC20 because the Defi ecosystem makes tokens and tokens can be used to buy things instead of bleeding the ecosystem.

To use crypto to buy goods and services is just one project of many that can keep tokens in the ecosystem.

There is the Tokenization of Things ToT (trademarking this lol ![]()

![]() ) with applications in construction and recycling of materials, energy, information, IoT and much more. I could be here for days creating projects that because of Harmony ecosystem can happen.

) with applications in construction and recycling of materials, energy, information, IoT and much more. I could be here for days creating projects that because of Harmony ecosystem can happen.

What is wrong with attending or creating events onboarding as many people as possible? I keep suggesting bringing non-crypto people, especially artists and creatives via the NFT route. Bring them all, then manage the influx with education and guidance make sure there are reasons to keep their $ONE and HRC20 they will be getting. Make sure they is utility in the ecosystem!

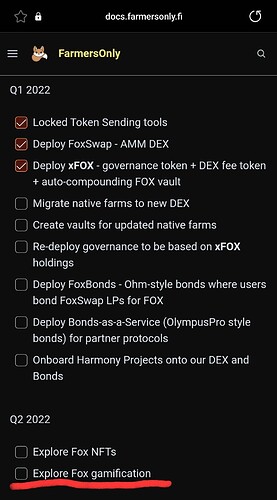

So DEXs don’t have to lock tokens and we can use them within the ecosystem

Furthermore, I read Hermes Team are “Enthusiasts”. Why is this a bad thing?

This is the precise argument I had with a dev and had many times with various creatives over time. What makes anyone think that if you don’t do coding you are not valuable. The Dev that left the above project wanted almost all the payment because was “doing all the work” and holding to ransom the whole project. Thus, if I had given in this would have “milked” all the Harmony grant and there will be nothing left to grow the business. He could not even wanted to understand that there are expenses like we need a server and marketing and there are others on the project!!

I have coded before and I’m learning a bit about web3 coding as and when I have some time. But that is not the point to do everything myself the point to build a team.

There is one non-crypto not even a crypto enthusiast in the Harmony Pay team but I value their presentation and management skills. I am working to bring in the team an international crypto influencer and crypto tech start-up expert.

Should I not value them as they are classified as “enthusiasts” ?

On another note, DAOs sound good but we need to get a grip of some existing realities. Value the community yes. So, we need to develop tools for mass participation until then I feel we need hybrid governance and some structure. People want to know who they are talking to so they can have the confidence to buy into $ONE. A great example is the operation or pure R&D teams.

Also, investors when they are cashing out their earrings they should have incentives to cash on another HRC20 token or stable coin or a project or if they want to buy a Lambo or an apartment etc they only using their HRC20 within the ecosystem.

Let’s also build ZPK and systems that avoid corruption!

We are very early so let’s not collapse the ecosystem just in case this article becomes a reality. The Article is a real possibility and not a scaremongering FUD as similar things have happened before eg .COM, Telecomm and Biotech baubles bursts to name a few.

Let’s change this when Lambo mentality and make a valuable ecosystem.

If we can bring this discussion to another Talk Harmony thread I think it will be worth chatting to see how we can work on threats and vulnerabilities so we can convert them to opportunities and new products so Harmony grows.